Codat

Build deeper connections with your business customers.

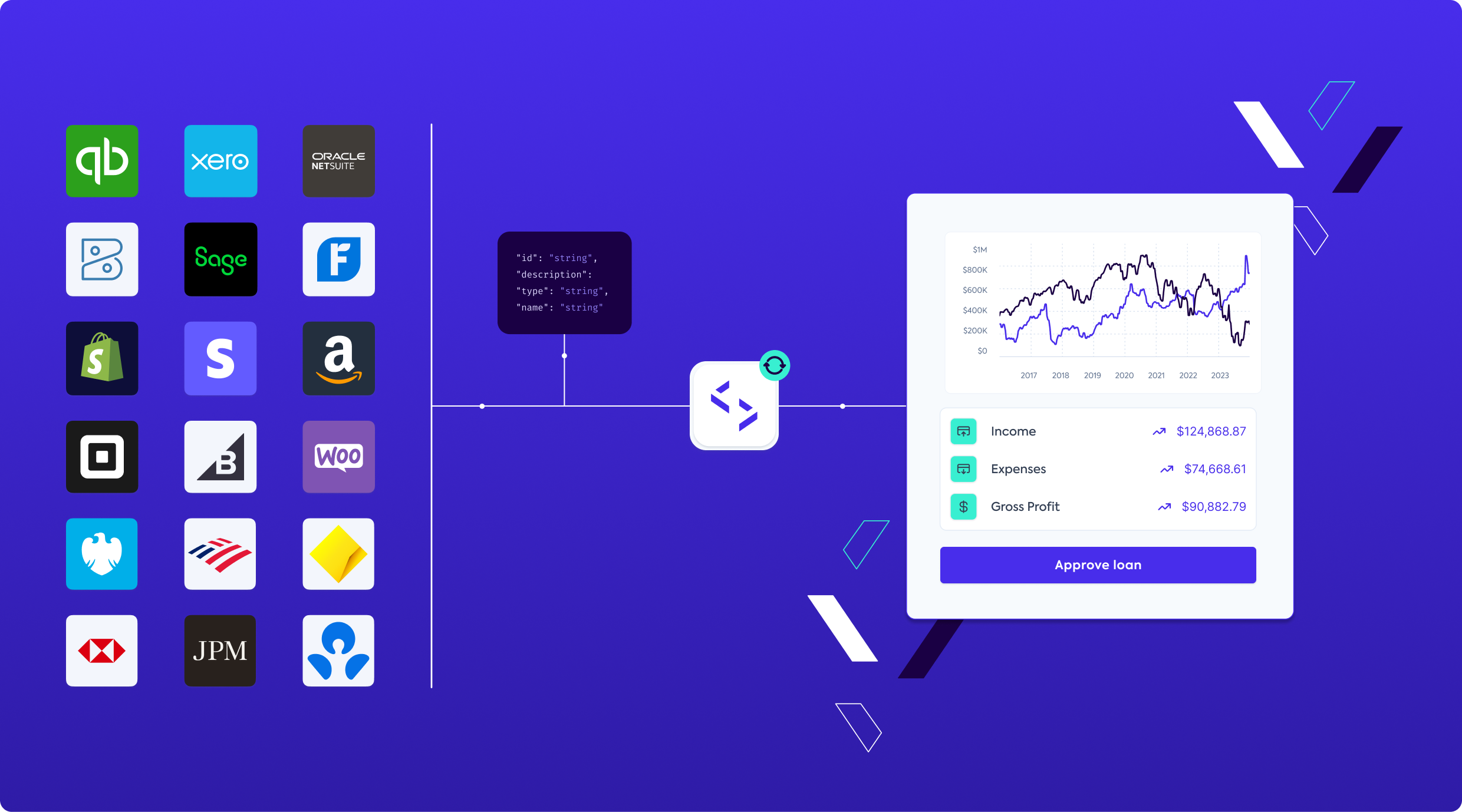

Codat makes it easy to access, synchronize, and interpret data from customers’ financial software for specific use cases, such as onboarding suppliers to commercial card programs and underwriting business loans.

The world’s largest banks use Codat to grow share of wallet, reduce churn, and scale operations.

More information about Codat’s data products

At the foundation of all of Codat’s products is secure, reliable, permissioned access to data from any major accounting, banking or commerce platform, in a standardized format.

On top of this infrastructure, our products are tailored for specific use cases, enriched with additional insight and features to maximize results for clients.

Use Cases

Supplier Enablement

- Codat’s Supplier Enablement product helps issuing banks get access to comprehensive and up-to-date supplier data to grow commercial card volume.

- Business clients share vendor and spend data directly from their ERP or accounting system. Supplier enablement teams get consistent and comprehensive supplier and spend files, refreshed on an ongoing basis so they can move more volume to card and increase sales conversion.

Business Lending

- With Codat’s Lending API, lenders can easily access customers’ accounting banking and payment processing data for more efficient and profitable business lending.

- Business customers share their data in a few clicks with a pre-built connection flow, to save lenders hours on painful document collection.

- Regardless of which financial software customers use, Codat standardizes the data into a single data model, tailored for business lending.

- Codat enriches the banking data and financial statements with spend and income categories so lenders can automatically calculate financial metrics and produce a cash-based profit and loss.

Accounting Sync

- Neobanks and payment providers use Codat to embed accounting automation features into their products to save customers hours on their financial admin.

- By automatically syncing payment transaction data into accounting and ERP systems, providers can make their solution customers' preferred payment method, increasing payment volumes up to 8x and reducing the likelihood of churn.

- Codat’s products include embeddable UI components for the user to configure their sync according to their preferences, regardless of which accounting platform they use.

Program

Fintech Partner Connect

Capability

Value Added Services