Pinwheel

Income data engineered for fintech innovation

Making sense of real time income and employment data helping you become the primary bank, reduce risk, and activate users.

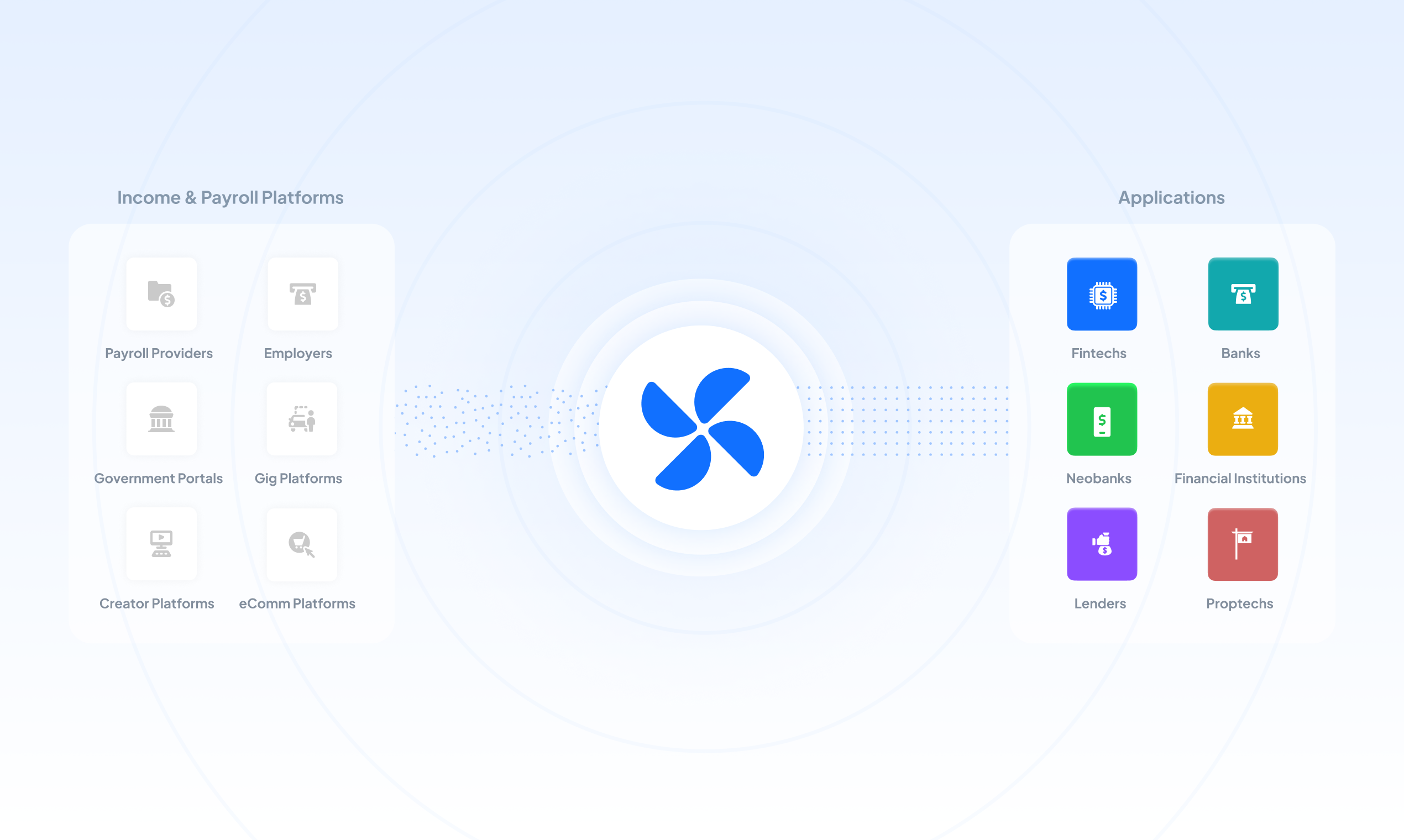

Pinwheel’s mission is to create a fairer financial system. We are the income layer enabling customers to build financial fairness for everyone. Pinwheel was founded in 2018 as the world's first payroll API. Pinwheel’s API covers over 80% of US workers and enables use cases across automated income and verification, direct deposit switching, earned wage access and more. Our products include Deposit Switch, Verify, Taxes and Earnings Stream and enable use cases for banks, lenders, fintechs, and more.

Pinwheel Solutions

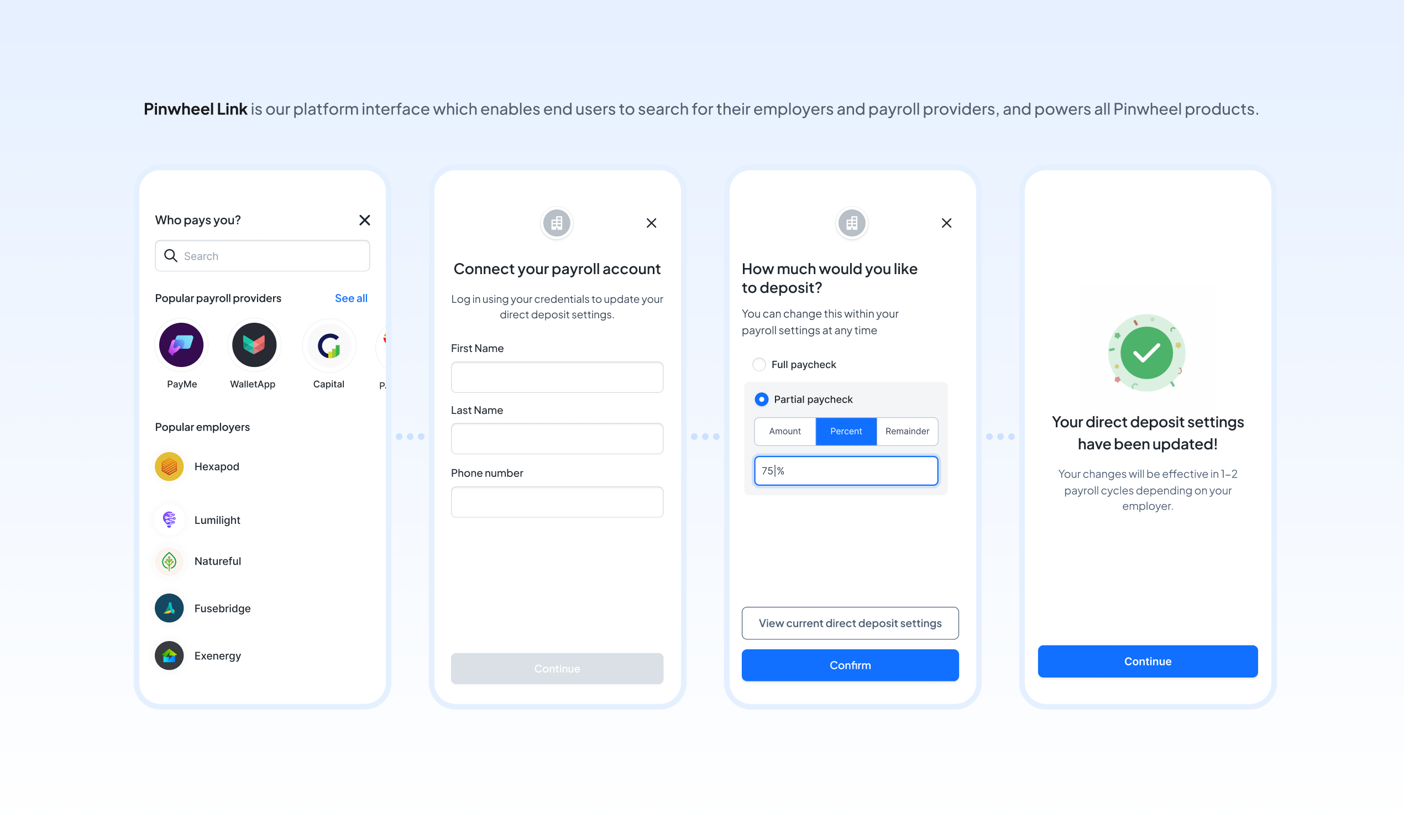

- Pinwheel Deposit Switch: Seamlessly automate direct deposit switching. Grow lifetime value, increase retention and profitability, and become your customers’ primary financial institution.

- Pinwheel Earnings Stream: Get real-time customer income data with actionable insights. Sourced from payroll and time-and-attendance systems, you can leverage these insights to reduce risk, boost engagement, power new financial products, and lower acquisition costs. See your customers actual historical cash flows, accrued earnings and projected earnings and pay dates.

- Pinwheel Taxes: Make taxes less taxing. Win consumer sentiment by being their go to place for all financial needs. Automate the tax form retrieval process to help build solutions that make taxes less of a hassle for your customers. Increase conversion, reduce friction and improve the user experience.

- Pinwheel Verify: Tap into the power of verified income and employment data. Access consumer-permissioned income and employment data to help you manage lending risk, improve underwriting models, increase repayment rates, and more. Pinwheel provides data that includes identity, employment, income, paystubs, and shifts.

Program

Fintech Partner Connect

Capability

Value Added Services