NovoPayment

Enabling Digital Financial Services

NovoPayment, a category leader in the area of Banking as a Service (BaaS) platforms across the Americas, enables digital financial and transactional services in support of varied use cases. Its bank-grade solutions use APIs and other flexible delivery models to help banks, FIs, merchants, networks, neo banks and other financial service providers to leverage their existing systems to generate new deposits, transaction streams and customer experiences.

PARTNER DETAILS

Visa Ready

Program Manager

Accelerate your time to market. As a principal Visa member, NovoPayment enables streamlined setup of your card program.

Quickly configure prepaid, debit, and credit card BINs for instant card issuance.

Access cross-border connectivity. NovoPayment’s local knowledge and connections can help you accelerate adoption throughout the Americas.

Simplify supplier relationships. NovoPayment’s modular, end-to-end approach means you can easily consolidate your BIN sponsor and supporting services.

Solution Information

| Visa Credential and Card Support |

Prepaid, debit, credit, consumer, small business, commercial |

| Full Stack Solution | Yes |

| In-House Processing | Yes |

| Processor Relationship with Visa Endpoint | Yes |

| In-House Visa License | Yes (In Some Markets) |

| In-Region Support |

Yes |

| BaaS Offering |

Yes |

| Over the Counter Cash Load Networks |

Yes (In Some Markets) |

| Instant Digital Issuance Support |

Yes |

| Additional Fraud and Risk Solutions |

Yes |

| Customer Fraud Rules |

Yes |

| Customer Service Offerings | Yes |

| Local Language Support | English, Spanish |

| White-Label App | Yes |

| Portfolio Management | Yes |

| Multi-Currency Wallet Solution | Yes |

| Visa Direct Origination | Yes |

| Cryptocurrency Support |

Yes |

| Installments Support |

Yes |

| Real-Time Risk Scoring |

Yes |

| Other Capabilities |

AML as a Service, AML-as-a-service, Launch Support |

Program

Visa Ready

Capability

Program Manager

Visa Ready: Issuer Processor

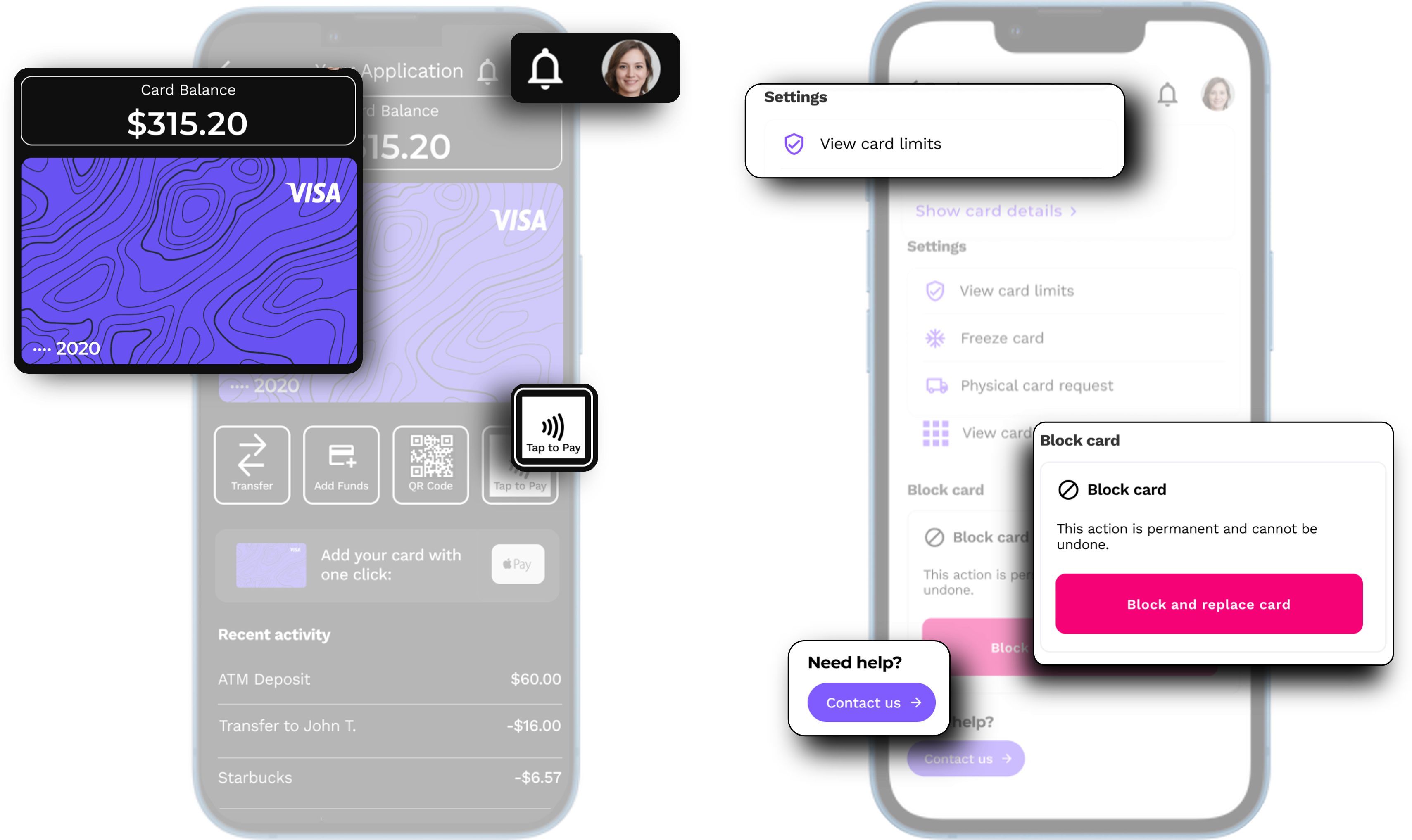

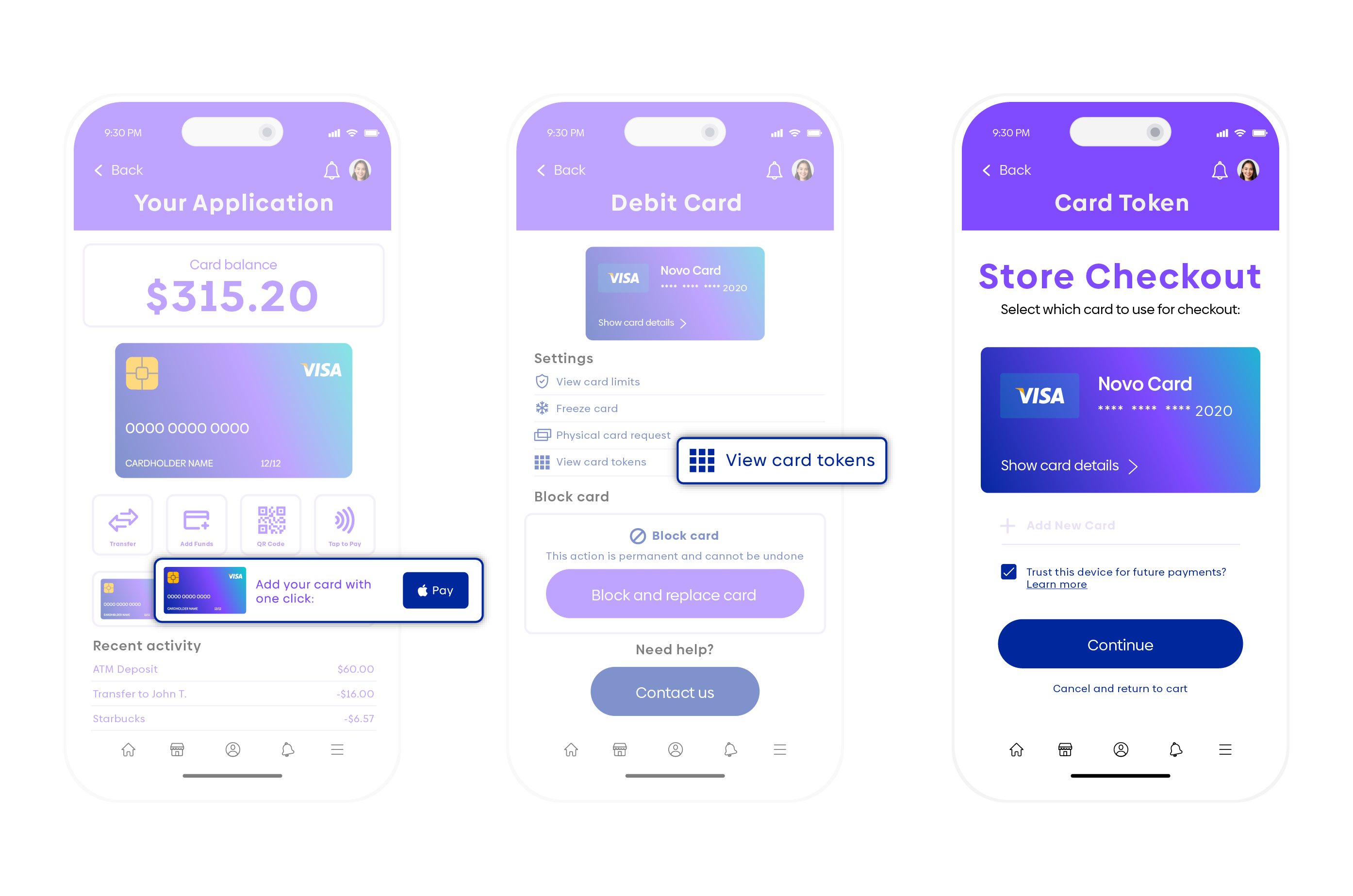

NovoPayment provides instant card issuance and payment processing for credit, debit, and prepaid programs.

Extend your brand, solve real challenges, and drive financial inclusion by providing customized, configurable card programs through NovoPayment.

Leverage NovoPayment’s Application Network to create highly configurable card programs. NovoPayment integrates and orchestrates your preferred providers and networks.

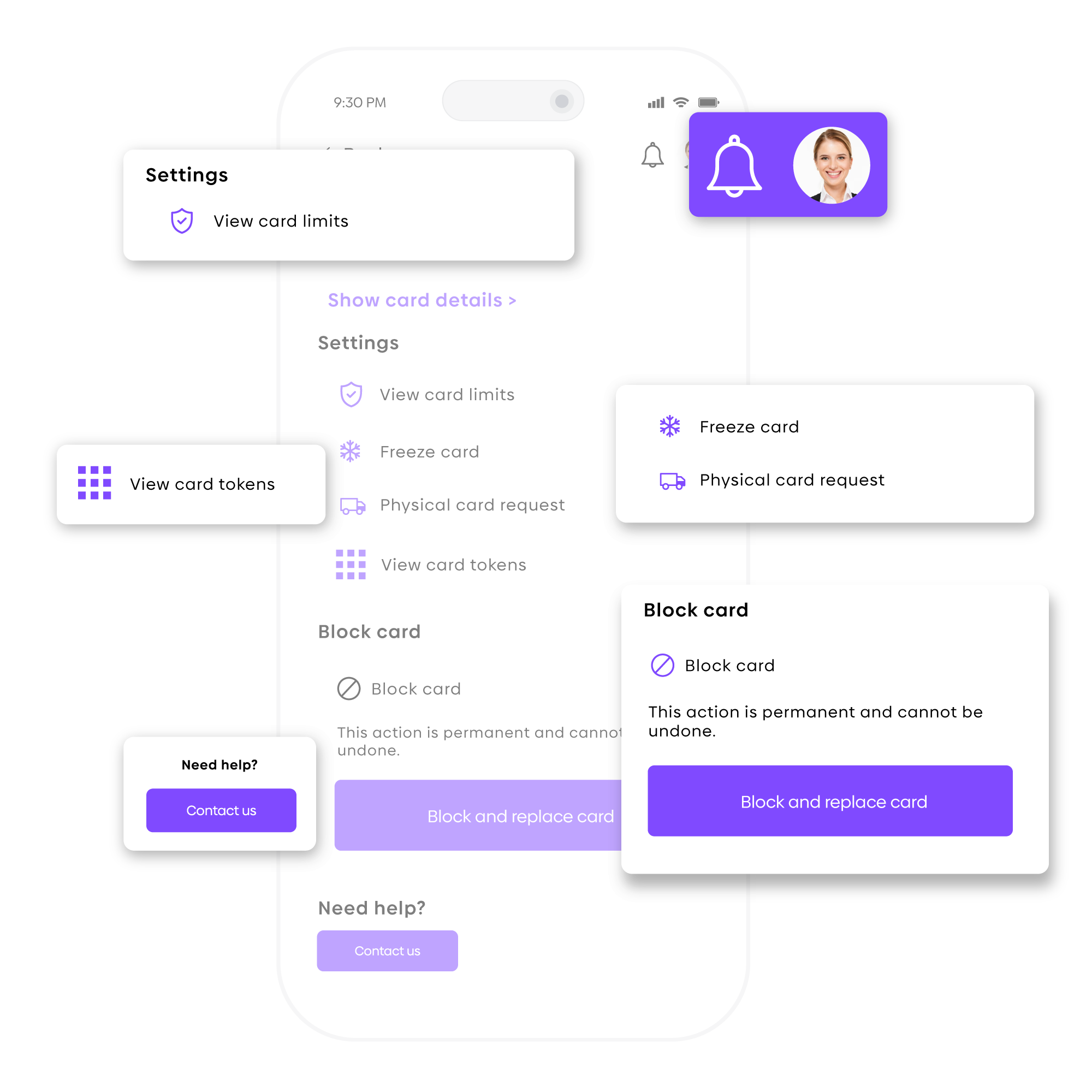

Security, card controls, rewards. Complete control, security, and fully digital functionality at your fingertips.

NovoPayment’s Business Intelligence Reporting Suite provides all the data needed to gain insight into your programs and customers.

Solution Information

| Visa Credential and Card Support |

Prepaid, Debit, Credit |

| In-Region Support |

US, Mexico, Colombia, Ecuador, Peru, Venezuela, Chile |

| Solution Deployment |

Cloud |

| Tenancy Architecture |

Multi-product / Multi-client / Multi-BIN |

| Comprehensive APIs |

Yes |

| Sandbox Testing Environment |

Individual testing environments for all NovoPayment clients |

| Uptime Availability in Region(s) | 99.99% |

| Visa Token Service (VTS) Support |

Manual Provision, Push Provision |

| Visa Direct Support |

Yes |

| Visa QR Payments ("Scan to Pay" Support) |

Yes |

| Customizable Authorization Decisioning |

Yes |

| Reporting |

Customizable, API-based |

| Authorization Flow |

Fully Managed, Partially Managed |

| Incremental Authorization |

Yes |

| Instant Funding / $0-Balance Transactions |

Yes |

| Proprietary or Visa Access Control Server (ACS) |

Yes |

| Risk-based Authentication (3DX 2.0) |

Yes |

| Real-time Risk Scoring |

Yes |

| Custom Fraud Rules |

Yes |

| BIN Sponsor Connections |

Yes |

| Program Management / End-to-End |

Yes |

| Full-service Credit Program Management |

No |

| Multi-currency Partitioning |

Yes |

| Visa Value-added Services Integration |

Visa Transaction Controls, Visa Global ATM Locator |

| Other Value-added Services Integrations |

eKYC |

Program

Visa Ready

Capability

Issuer Processor

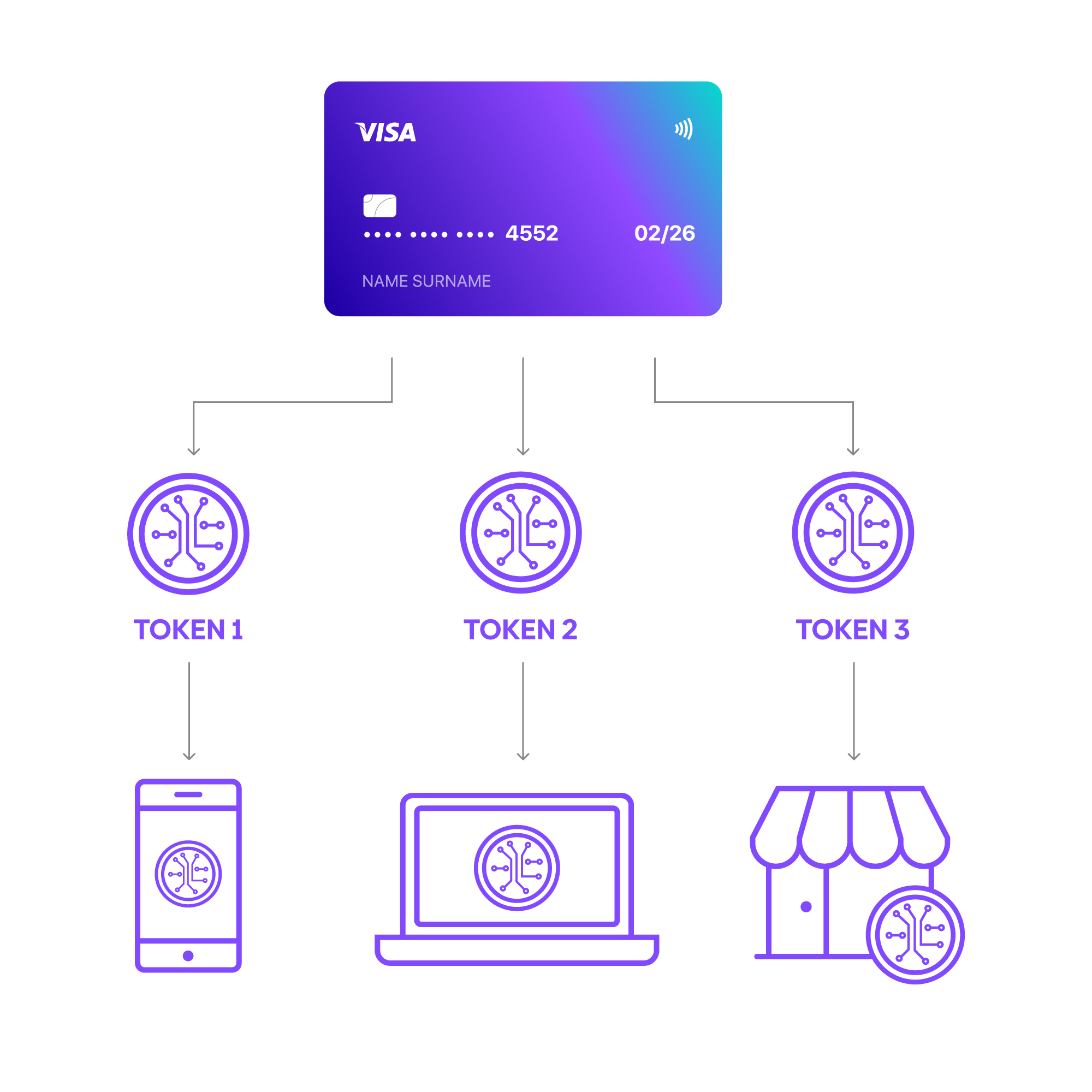

Card Tokenization (I-TSP)

- NovoPayment tokenizes Visa payment credentials, transforming sensitive data into randomly generated tokens that can’t be exploited by bad actors.

- Tokenization allows users to safely store card information in digital or mobile wallets and at preferred e-commerce sites, for immediate access

- NovoPayment is a Visa-Ready certified partner, affording you the benefits of tokenization without the upfront costs

Program

Visa Ready

Capability

Token Service Provider (TSP)

NovoPayment Token Requestor Services

As a leading enabler of tokenization services, NovoPayment facilitates more effective transactional security and better user experiences.

NovoPayment’s API’s enables cardholders to store their cards in Digital Wallets, wearables, e-commerce sites, and more, maximizing user convenience and issuer wallet share.

NovoPayment’s token manager allows users to easily view and manage all their card tokens, creating simple and digital-first user experiences.

Program

Visa Ready

Capability

Token Service Provider (TSP)

Scan to Pay (MPQR)

Whether you’re a mom-and-pop entity or a multinational enterprise, NovoPayment takes care of all the necessary integrations so you can quickly realize the benefits of quick response (QR) code technology:

- Bypass the need for pricey point-of-sale hardware

- Access everything you need to generate QR codes and get paid in seconds

- Choose from static QR codes where customers input a purchase amount or dynamic QR codes that represent each of your products

- Meet EMVCo standards for merchant-presented QR Codes

Program

Visa Ready

Capability

Token Service Provider (TSP)