Atomic

Unlocking revenue opportunities through client payroll connectivity.

Atomic's payroll APIs provide the infrastructure for financial institutions to connect consumers to their employers’ payroll systems. Tapping into these systems unleashes many opportunities for financial institutions, including access to financial data for verification of income and employment, the ability to offer consumers automated set-up or updating of direct deposits, collection of financial obligations straight from consumer’s paychecks, early access of tax withholdings for your clients, and ability to provide clients access to earned but unpaid wages.

Atomic simplifies complicated payroll integrations with APIs whose coverage encompasses over 450 unique payroll connections, including incumbent payroll providers, enterprise solutions, modern HR tech providers, gig-economy platforms and government systems. Currently, our APIs are accessed by over 125 million employees, encompassing approximately 75% of the U.S. workforce.

PARTNER DETAILS

Visa Ready: Fintech Partner Connect

Deposit - Digital Direct Deposit Set Up and Switching

Reach out to our team get more information on our solution.

SOLUTION INFORMATION

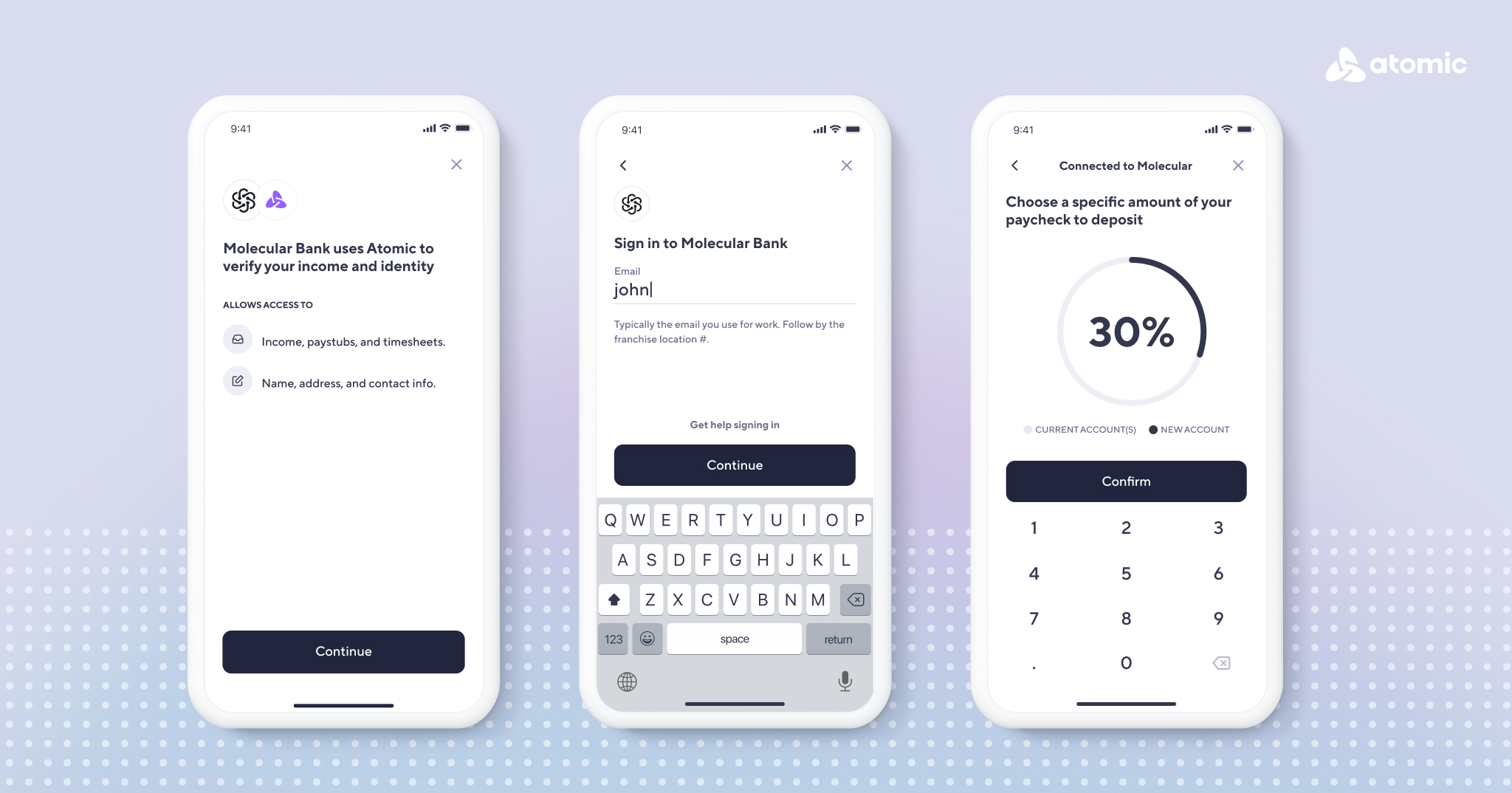

Consumer-permissioned, our Deposit API lets consumers automatically update or switch direct deposits from your website or app so they can fund straight into your financial institution. This means no more paper to update or establish direct deposits and no more outrageous wait times for changes to be processed so funds can start hitting destination accounts.

SOLUTION CAPABILITIES

- Clients can digitally update or switch direct deposits to your financial institution

- Direct deposit changes go into effect the same or next pay cycle

- Username and password credentials can be setup or reset in minutes, right from your website or app

KEY BENEFITS

- Less costly direct deposit acquisition than traditional methods

- Easily embed into your website or app using our software development kit (SDK)

- Fewer chances of identify fraud as you verify applicants’ identities directly from payroll systems

.jpg)

Program

Fintech Partner Connect

Capability

Value Added Services

Verify - Automated Income and Employment Verification

Reach out to our team get more information on our solution.

SOLUTION INFORMATION

Our Verify API lets employees, including gig economy workers, connect to their payroll systems–with their permission and directly from your app or website. Once they do, you can benefit from source-direct access to the information found in their payroll, such as annual income, hourly income, pay cycles and more. Using this information, you can digitally validate identity, employment and pay without manual resources, effort or the usual wait time.

SOLUTION CAPABILITIES

- Digital validation of identity, income and employment

- Works with all employees, including those in the gig economy

KEY BENEFITS

- None of the wait time usually associated with manual processes

- Faster, speedier processing of income and employment verifications

- Prevents erroneous or falsified manual information from carrying weight in lending decisions

Program

Fintech Partner Connect

Capability

Value Added Services

EarlyPay - The Gateway to Providing Earned Wage Access

Reach out to our team get more information on our solution.

SOLUTION INFORMATION

With EarlyPay, consumers can bypass loans and financial assistance from friends and family by accessing earned wages they’ve accrued but have yet to be paid for. By offering this solution, financial institutions avoid losing client account primacy to other EWA providers while empowering clients access to money they’ve already earned, so there’s no opportunity for defaulting like there is with unearned funds.

SOLUTION CAPABILITIES

- Enables access to earned but unpaid wages

- Allows access to wages ahead of employers’ pay cycles

KEY BENEFITS

- Bolsters client loyalty for financial institutions

- Helps you offer funds faster and with more confidence than with manual loan processes

- Eliminates the need for client payday loans

Program

Fintech Partner Connect

Capability

Value Added Services